Posted October 28, 2025

By Today's Tech FWD

OpenAI Goes For-Profit

Greg Guenthner:

Microsoft, OpenAI Agree to New For-Profit Deal. Windows Maker Gets 27% Stake.

Microsoft (MSFT) and OpenAI announced on Tuesday that they have reached a new agreement that lets the ChatGPT developer move forward with its plans to transform into a for-profit public benefit corporation.

Under the new agreement, Microsoft will hold 27% of the OpenAI Group PBC, valued at roughly $135 billion, while OpenAI's nonprofit arm will hold a $130 billion stake in the for-profit entity. Microsoft will no longer have the right of first refusal to serve as OpenAI's cloud provider, but OpenAI has contracted to purchase $250 billion worth of Azure services.

Microsoft will retain rights for OpenAI's models and products, excluding consumer hardware, through 2032 – including models and products developed after OpenAI declares it has achieved general intelligence.

Both companies have benefited immensely from their relationship, with Microsoft's stock price soaring thanks to the huge amount of cash OpenAI has spent on its Azure cloud platform. Microsoft, meanwhile, provided billions in investments to OpenAI. That has helped put the two companies in the lead in the AI race.

But OpenAI has broader expansion plans, including its Stargate Project, which will consist of a series of massive data centers across the country that use Oracle's (ORCL) cloud services.

Enrique Abeyta:

Palmer Luckey, America's Secret Weapon in Flip-Flops

Thirty-year-old CEO Palmer Luckey is usually seen in a Hawaiian shirt and sandals (even at prestigious events) with a mullet down to his shoulders. But you’d be wrong to dismiss him.

He’s one of the founders of Anduril Industries, a tech company that’s taking a Silicon Valley approach to America’s notoriously slow-moving and bureaucratic defense industry. Luckey wants a defense industry built around products and profits rather than huge governmental support programs.

Those governmental supports are how you get projects like the Lockheed Martin F-35 Lightning II program, estimated to eventually have costs exceeding $2 trillion (!) over its lifetime. Meanwhile, the new era of warfare looks a lot more like consumer electronics than our World War II military-industrial complex.

Needless to say, the current defense industry leaders are not positioned at all for this new era. This runs counter to Luckey's goal of making America the world's arms dealer of the future.

If Luckey is able to realize his vision with Anduril, he could become the richest man on Earth someday, even surpassing Elon Musk. And while Anduril isn’t public yet, it could be the next Palantir — currently up 1,973% from its IPO five years ago.

Chris Campbell:

BlackRock-Linked Tokenization Firm Securitize To Go Public via SPAC Deal

Securitize, the “real world assets” platform that powers BlackRock’s tokenized money market fund, will go public through a merger with a special purpose acquisition company, CEO Carlos Domingo told CNBC.

The fintech firm will merge with Cantor Equity Partners II, Inc., a blank-check company sponsored by an affiliate of Cantor Fitzgerald that trades under the CEPT ticker. The deal values Securitize’s business at $1.25 billion in pre-money equity.

“Tokenization is what everybody’s talking about … but there’s nobody publicly traded that does it,” Domingo said. “We will do well in the public market because people want to index themselves to tokenization the same way that people are buying Circle because they want to index themselves to stablecoins.”

Tokenization refers to the registration of ownership rights to real-world assets such as stocks, bonds or gold on a blockchain. The process enables more transparent and around-the-clock trading versus traditional methods, according to its proponents — among whom are Robinhood Markets CEO Vlad Tenev and BlackRock CEO Larry Fink.

Following the merger, the combined entity Securitize Corp.’s stock will trade on the Nasdaq under the ticker symbol SECZ. Shares could begin trading on the exchange as soon as January, according to Domingo.

Sign Up Today for Free!

Today’s Tech FWD compiles all the best trading tips and market insights straight from our panel of distinguished analysts, including James Altucher, Ray Blanco, Chris Campbell, Greg Guenthner, Zach Scheidt and more.

Inside each issue, you'll find perspectives from our experts about speculative ways to trade, tech trends, crypto news and the latest AI opportunities so YOU can profit while the rest of the market is left behind.

Another "Big Short"

Posted November 04, 2025

By Today's Tech FWD

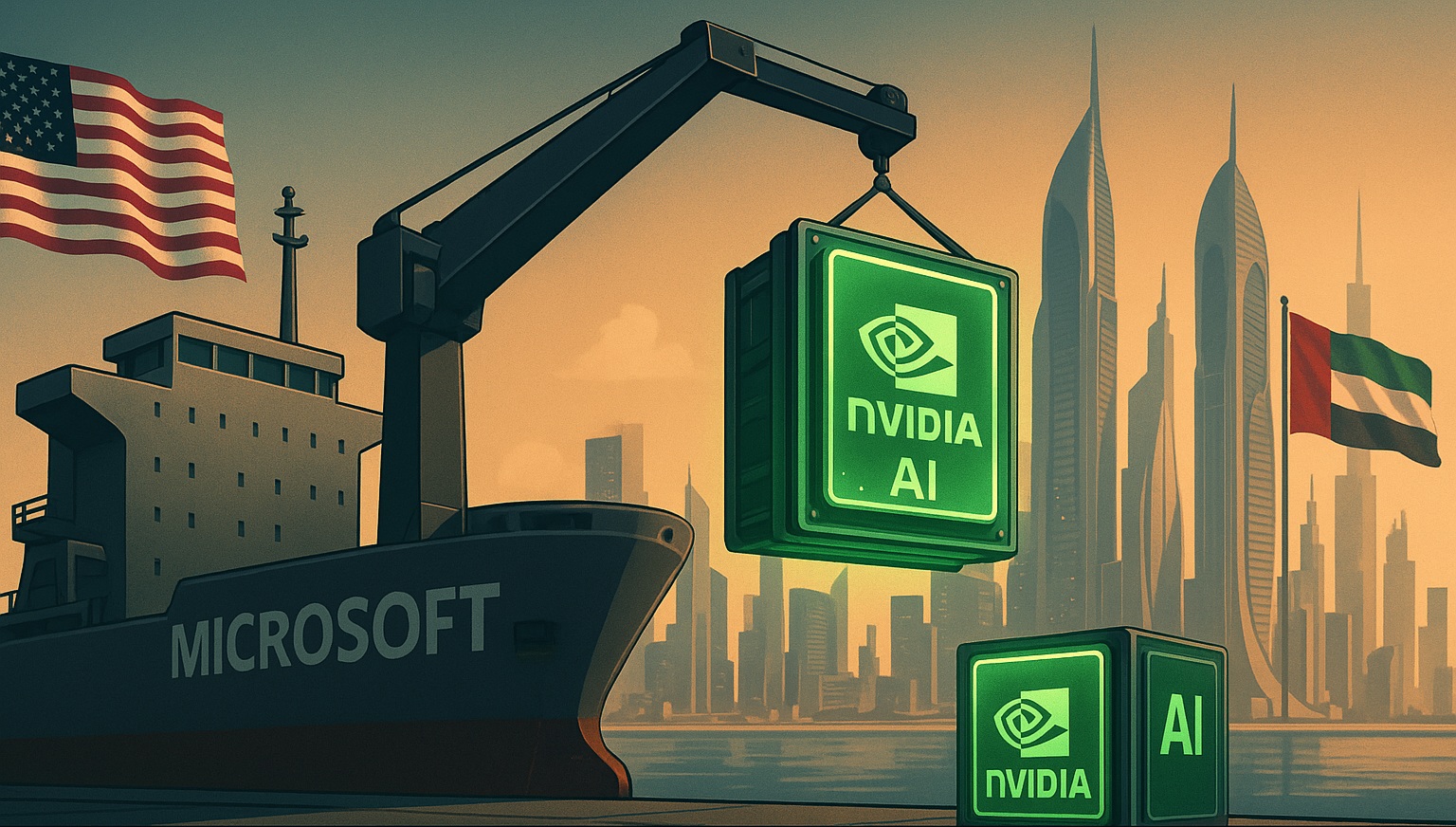

Arabian Superclouds

Posted November 03, 2025

By Today's Tech FWD

The Nightmare Before Moonvember

Posted October 31, 2025

By Today's Tech FWD

Puppets on Wi-Fi Strings

Posted October 30, 2025

By Today's Tech FWD

America Bets Big on AMD

Posted October 27, 2025

By Today's Tech FWD