Posted April 04, 2025

By Today's Tech FWD

Digital Goldilocks

Chris Campbell:

Bitcoin Begins to Decouple From Nasdaq as U.S. Stocks Crumble

After a frustrating few weeks in which bitcoin (BTC) prices seemed to move tick for tick with the Nasdaq, the world's largest crypto is showing some signs of going its own way as stock prices go from struggling to plunging.

With the Nasdaq following up its 6% tumble on Thursday with another 5% decline halfway through the day on Friday, the price of bitcoin is holding at around $83,000. That's about 1% higher over the past 24 hours and lower by just 3.5% since President Trump announced his tariff package on Wednesday evening.

The broader crypto market is also flashing strength, with the CoinDesk 20 Index climbing higher, led by 4%-5% gains of XRP, Solana's SOL and Cardano's ADA.

The decoupling — if it persists — could bode well for BTC's appeal among institutional investors seeking refuge from shaky stock markets.

James Altucher:

"This Tariff Stuff Is Bullsh*t"

America is the world’s biggest customer. Now, imagine you’re the biggest spender in the world—and your suppliers start taxing you just to buy their stuff. What did we do before? Smile. Nod. Take it.

Trump? He’s doing something different: he’s saying “no.” That’s the reciprocal tariff. If a country slaps a tariff on us, we slap one back—but only half as much. That’s it. It’s leverage. These tariffs are a message: “Play fair or lose access.”

Remember what happened last time we did this? No? That’s because it didn’t destroy the economy. Inflation stayed low (1.5%–1.9%) and the stock market soared (up over 40% between 2018–2020). Oh, and China and Mexico caved, resulting in 30,000 new jobs in the U.S. auto industry.

This isn’t about isolationism. It’s not about xenophobia. It’s about leverage. Everyone’s talking about whether Trump’s tariffs will “crash the economy.” But here’s a better question: Why should American workers be the only ones playing by the rules?

Greg Guenthner:

Crash to Comeback: 3 “Buy the Dip” Trades

A fresh bout of panic sent Wall Street reeling this week as Trump unveiled his tariff plan. Skittish traders began pounding the “sell” button Wednesday night, sending stocks cascading lower into Thursday’s session.

But now isn't the time to run scared. While everyone else is freaking out over tariffs, we’re searching for buying opportunities.

If we can take advantage of some of these potential overreactions across the market, we could rake in some serious gains if and when stocks start to bounce. Here are three of my favorite “buy the dip” opportunities heading into the weekend…

Apple Inc. (AAPL): Designed in Cupertino. Made in China. Next, we have Tesla Inc. (TSLA): the stock everybody loves to hate. And last, we have Nike Inc. (NKE), a stock that has been dragged through the mud for more than three years — and rightfully so!

Click the link below to read my full thesis on these bargain bin giants!

Sign Up Today for Free!

Today’s Tech FWD compiles all the best trading tips and market insights straight from our panel of distinguished analysts, including James Altucher, Ray Blanco, Chris Campbell, Greg Guenthner, Zach Scheidt and more.

Inside each issue, you'll find perspectives from our experts about speculative ways to trade, tech trends, crypto news and the latest AI opportunities so YOU can profit while the rest of the market is left behind.

Nvidia at a Grocery-Store Multiple

Posted February 27, 2026

By Today's Tech FWD

Pentagon Declares War on Anthropic

Posted February 26, 2026

By Today's Tech FWD

Pentagon Declares War on Anthropic

Posted February 25, 2026

By Today's Tech FWD

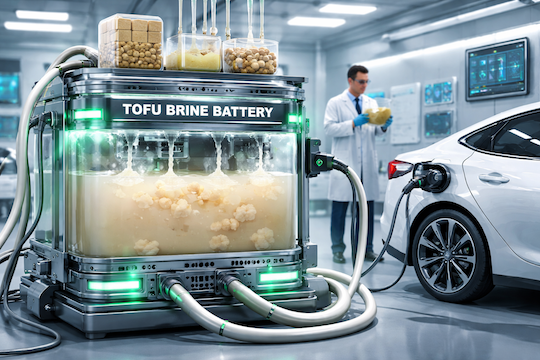

Tofu-Brine Super Batteries

Posted February 24, 2026

By Today's Tech FWD

The Atomic Recycling Revolution

Posted February 23, 2026

By Today's Tech FWD